DeepDive: Data Dump March 2024

China's manufacturing activity data for March were robust, partially due to the effects of the Lunar New Year, while also reflecting a more favourable external environment and policymakers’ continued focus on supply-side stimulus. Growth in new household deposits has slowed year-to-date, which could point to some improvement in household sentiment if this trend continues. Spending among both corporates and households, on the other hand, remains subdued, as shown by lacklustre retail sales, a reluctance among businesses to hire, a drop in the M1-M2 growth differential back to deeply negative levels, and household borrowing registering its worst reading since at least 2009 in February. Our March Data Dump has more.

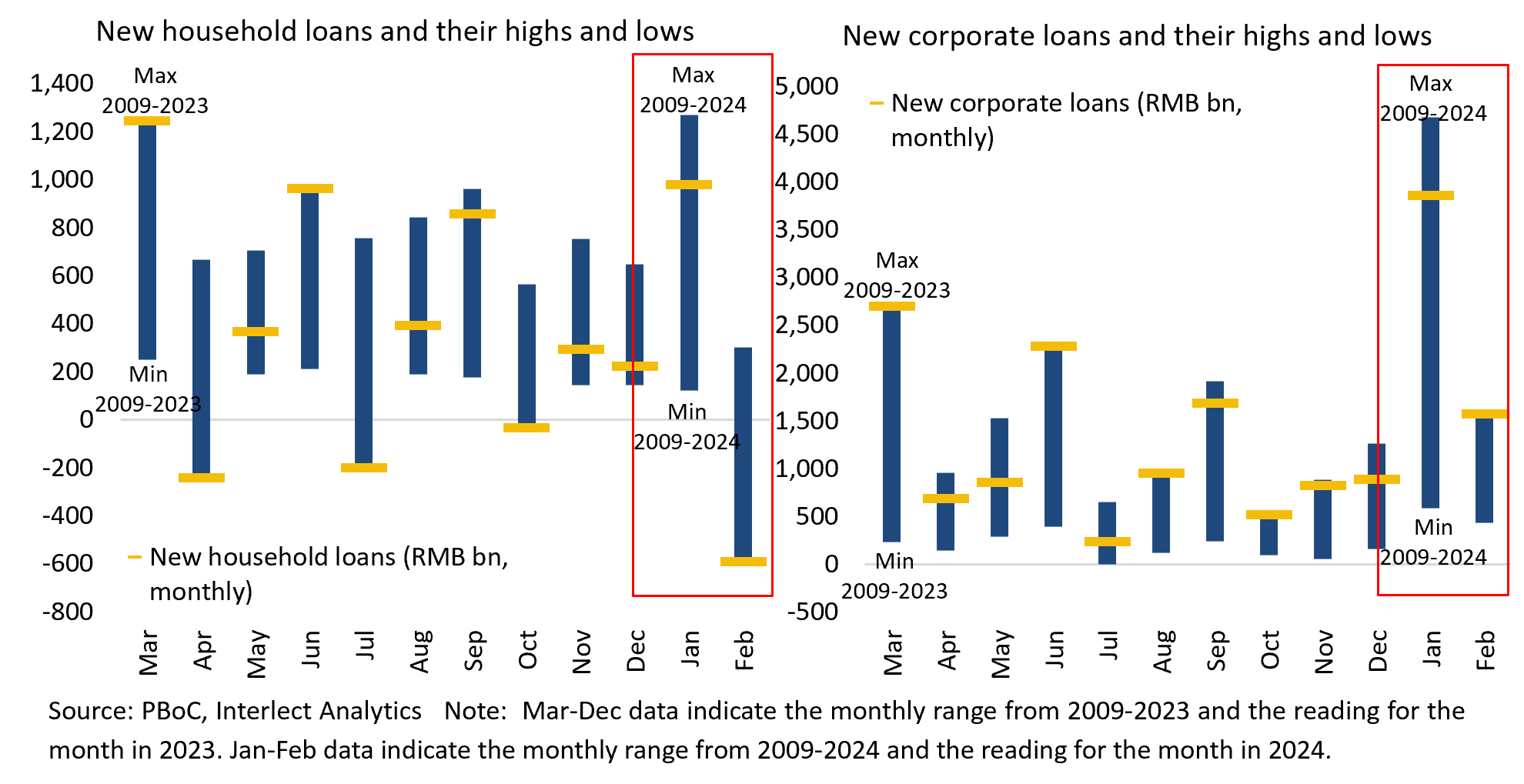

Corporate loan demand, while down nearly 14% year-to-date, was robust in February against a high base last year, when both January and February saw record highs. Borrowing activity early last year was driven by strong frontloading as the economy exited its pandemic restrictions. The slowdown this year appears to be in line with the PBoC’s communication and guidance since late last year to utilise existing loans more efficiently and smooth out credit growth across the year (i.e. less frontloading) (see DeepDive: Key Messages from the PBoC’s Monetary Policy Outlook).

Household loans, on the other hand, contracted sharply and posted their worst February going back to at least 2009. Both short-term and long-term loans fell substantially, suggesting continued subdued demand for consumption and home purchases. This points to a continuation of last year’s trend, with borrowing demand still largely coming from corporates, while household appetite remains lacklustre.