DeepDive: Signals from the Two Sessions

China’s government work report on Tuesday signalled robust support for the new economy going forward, aligning with the messaging coming out of the Central Economic Work Conference late last year. Policy stimulus signals, while still supportive, remained moderate overall, consistent with our expectations going into the two sessions. Policymakers also maintained their focus on risk and uncertainty, as shown by our text-based indicators. Our quantitative analysis filters out key themes of the report and examines their implications.

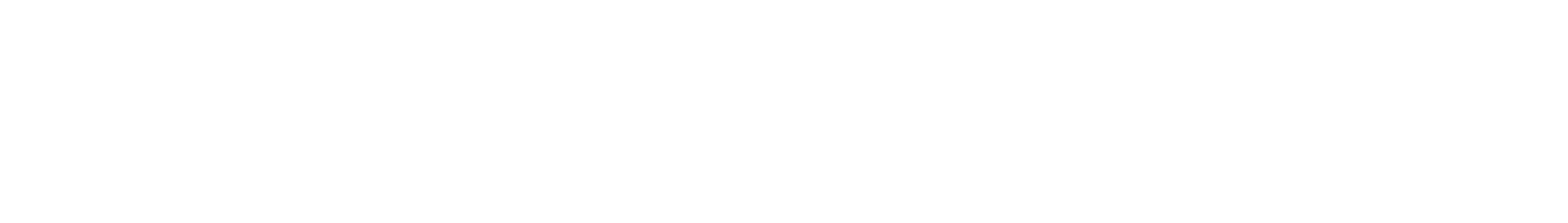

On Tuesday, China’s premier delivered the Report on the Work of the Government for 2024, which reviews accomplishments of the previous year and outlines expectations and priorities for the year ahead. The report’s outlook section maintained a strong emphasis on the new economy, as shown by our text-based new economy indicator, which captures topics related to digitisation, advanced manufacturing, robotics, cleantech, artificial intelligence, IOT, automated driving, telemedicine, cloud computing, and many more.

Specifically, the report singled out the digital economy, artificial intelligence, advanced manufacturing, hydrogen, new materials, intelligent and connected vehicles (ICVs), innovative pharmaceuticals, biomanufacturing, commercial space, the low-altitude economy, quantum technology, and life sciences, among others. These sectors largely align with the ones identified at the Central Economic Work Conference (CEWC) held late last year (see QuickScan: CEWC Doubles Down on New Economy), indicating their strategic importance for China’s future development. China has been doubling down on the new economy over the last two years, as it intensifies its efforts to climb up the value chain and strengthen self-reliance or self-sufficiency. This year’s two sessions and the work report have placed particular emphasis on artificial intelligence and the digital economy, referring to an “artificial intelligence+” initiative, which, in our view, suggests that the theme may receive considerably more backing going forward.

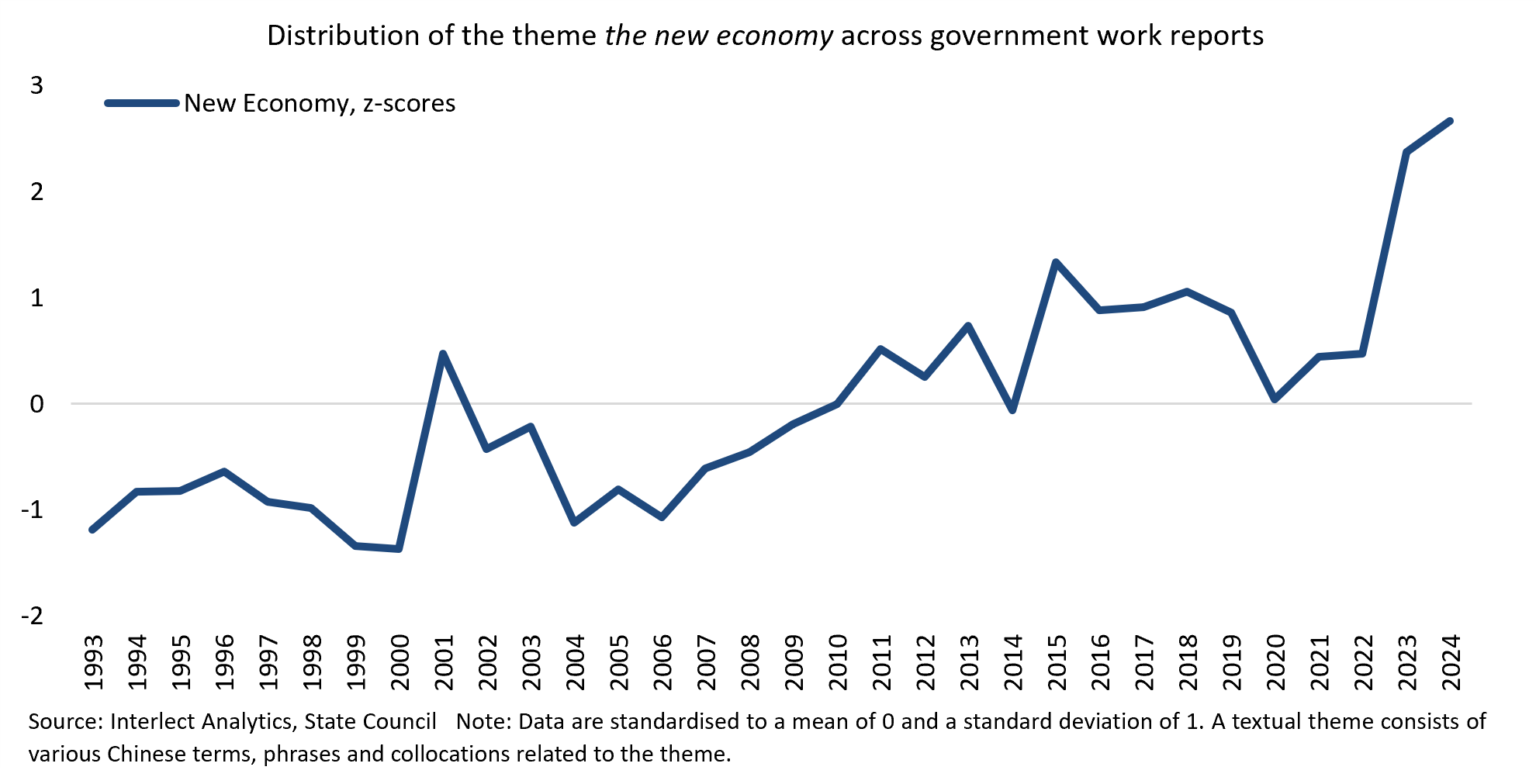

As we argued in our previous notes, while the new economy should stand to benefit from more government support in the years ahead, certain pockets will likely be adversely impacted by rising geostrategic risks. Some of these industries, including electric vehicles and advanced semiconductors, are already under heightened scrutiny and subject to escalating trade tensions (also see QuickScan: More Trade Tensions). We think this is a risk that is likely to increase this year and next, as suggested by the recent readings of our trade tensions indicator. This will make prudent selection key for those that wish to have exposure.

While China announced a GDP growth target of around 5% for 2024, we did not see many signs that would point to significantly stronger stimulus this year. This is in line with the expectations we had going into the two sessions. On fiscal and monetary policy, the report largely reiterated the language used in previous meetings, including last year’s CEWC and Politburo meeting (see QuickScan: CEWC Doubles Down on New Economy and QuickScan: Politburo Update December 2023), which we have interpreted as somewhat more hawkish, rather than dovish, while still being supportive overall (also see DeepDive: Nascent Signs of an Improving Outlook in the PBoC’s Messaging). In a press conference on Tuesday, the head of the drafting team of the report defended the fiscal measures and targets in the report as appropriate and as a moderate increase relative to last year, arguing they would leave some policy room in case further downside risks materialise, while keeping a lid on government debt and strengthening fiscal sustainability.

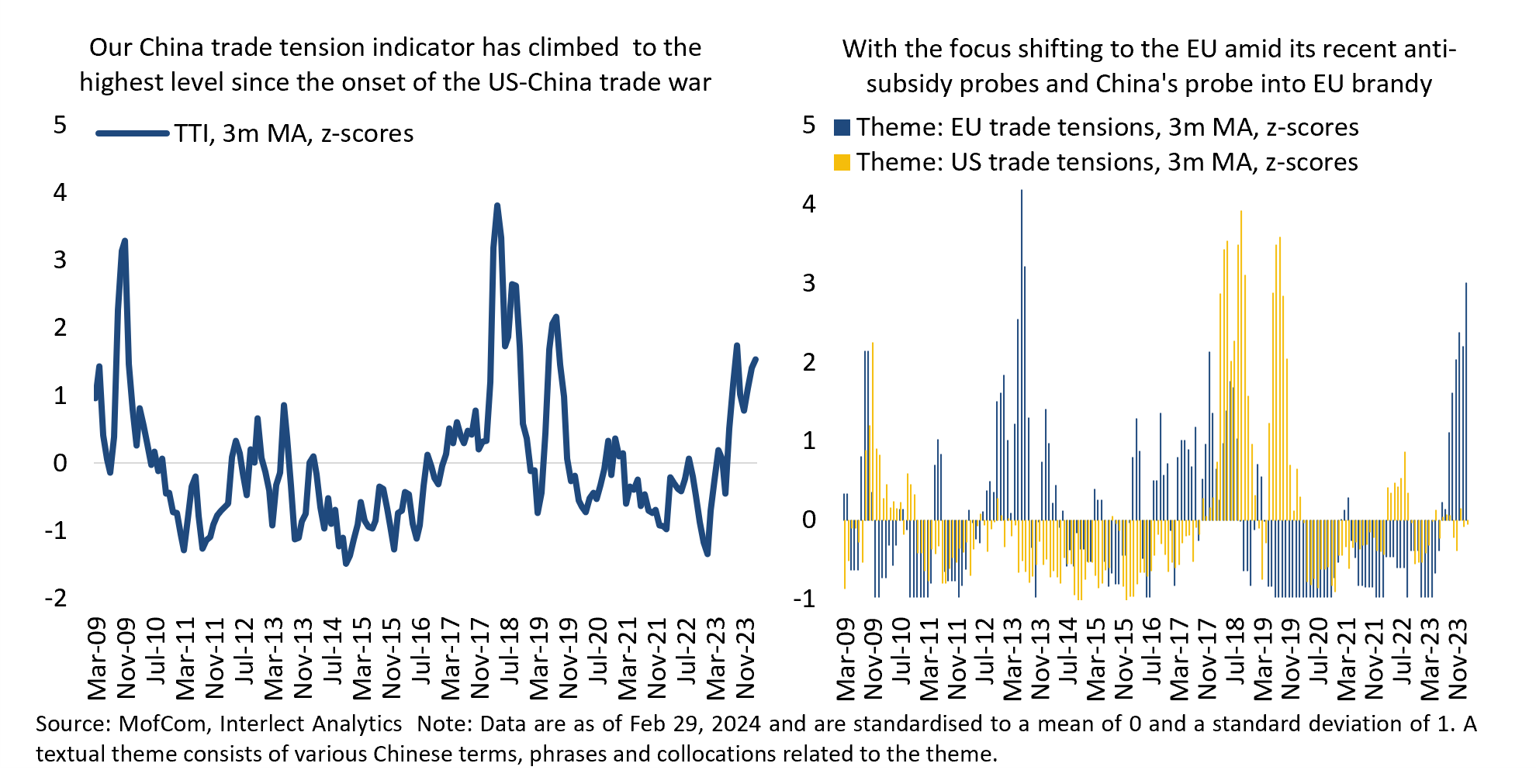

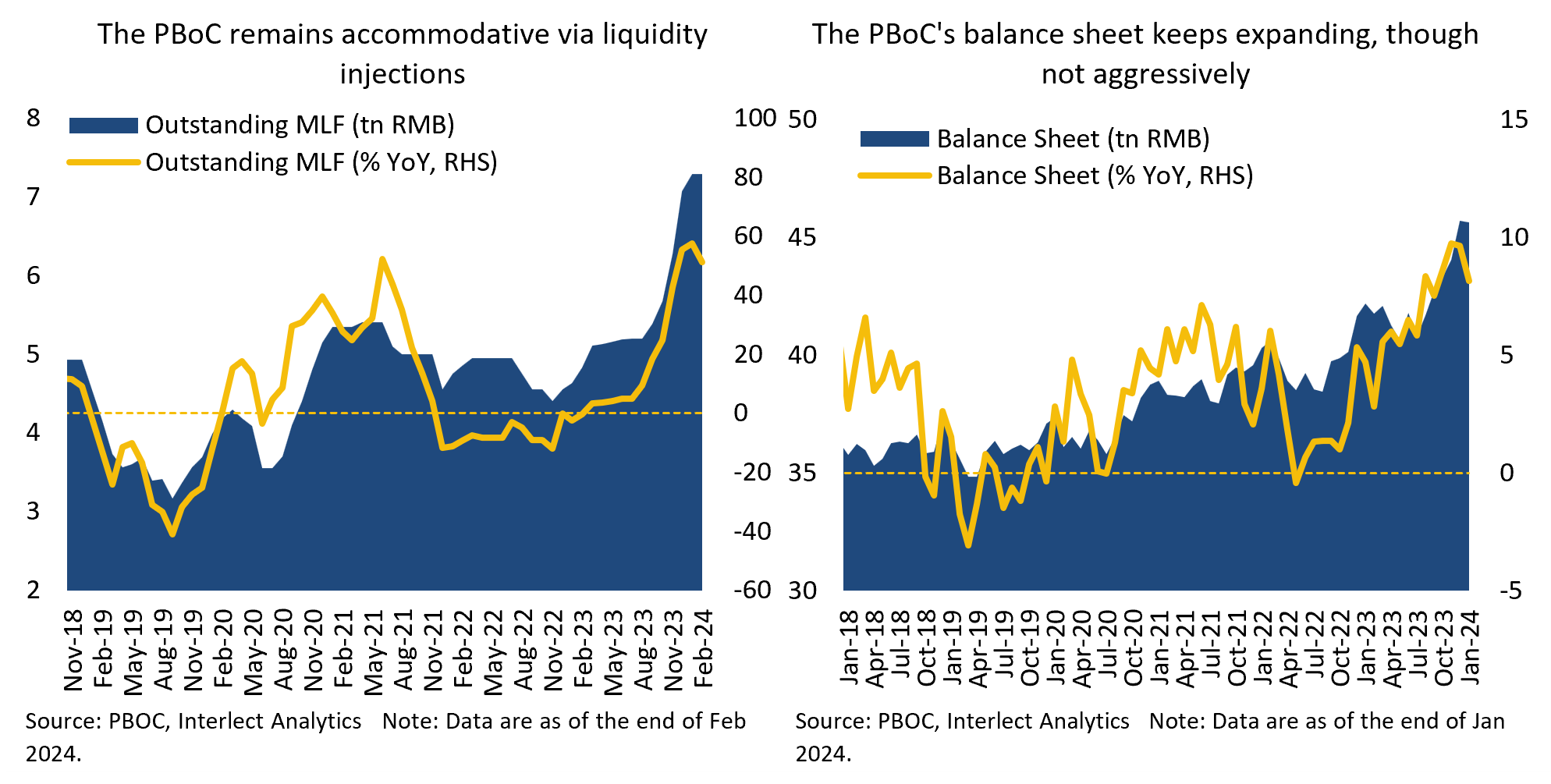

We have differed somewhat from the consensus view in that we believe that policy support has actually been fairly robust last year, as shown by the growing balance sheet and liquidity injections by the PBoC and the significant increase in China’s government debt-to-GDP ratio, which grew by over five percentage points year-on-year in Q4 last year. The ultra-long government bond announced in the work report, set to be issued annually for the next few years, starting with one trillion yuan this year, should also provide additional targeted support to strategic sectors of the economy. Similarly, the one-trillion sovereign bond issued last year, much of which will be deployed this year, should also contribute to this supportive stance. Overall, the message coming out of the two sessions seems to support our view that stimulus policy will remain accommodative but more moderate, barring any significant deterioration in the economic data, given policymakers’ apparent confidence in the current approach.

It is worth noting, however, that the measures appear to continue to prioritise the supply-side, while the market has been hoping for more specific steps aimed at boosting consumption. While mentions of the need to strengthen consumption and domestic demand remained elevated in this year’s report, the devil lies in the details, with policymakers, in fact, still largely focusing on boosting consumption through supply-side investment (also see QuickScan: CEWC Doubles Down on New Economy). The issue we see is that, while similar command-style measures worked well in the past, they have so far failed to significantly boost confidence and demand this time around. We think this is mainly due to persistent uncertainty in the property market and its drag on domestic confidence and demand, as well as weaker external demand, although we expect improvements in the latter this year (see QuickScan: Can the External Macro Environment Prove to Be a Boon?). Additionally, our sense is that stimulating domestic consumption has taken a backseat to industrial modernisation and the new economy in this year’s report, compared to last year when China was exiting its pandemic restrictions.

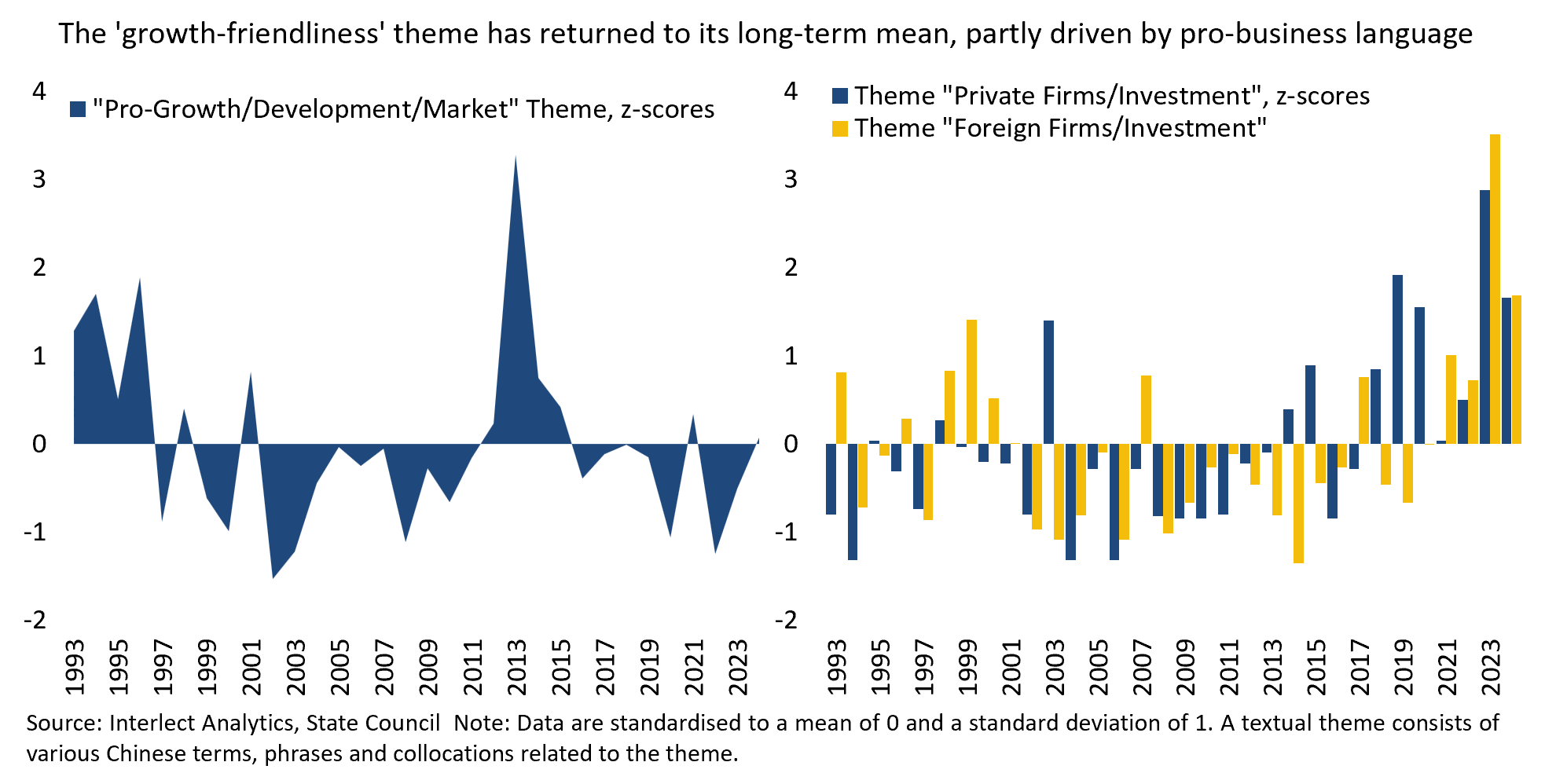

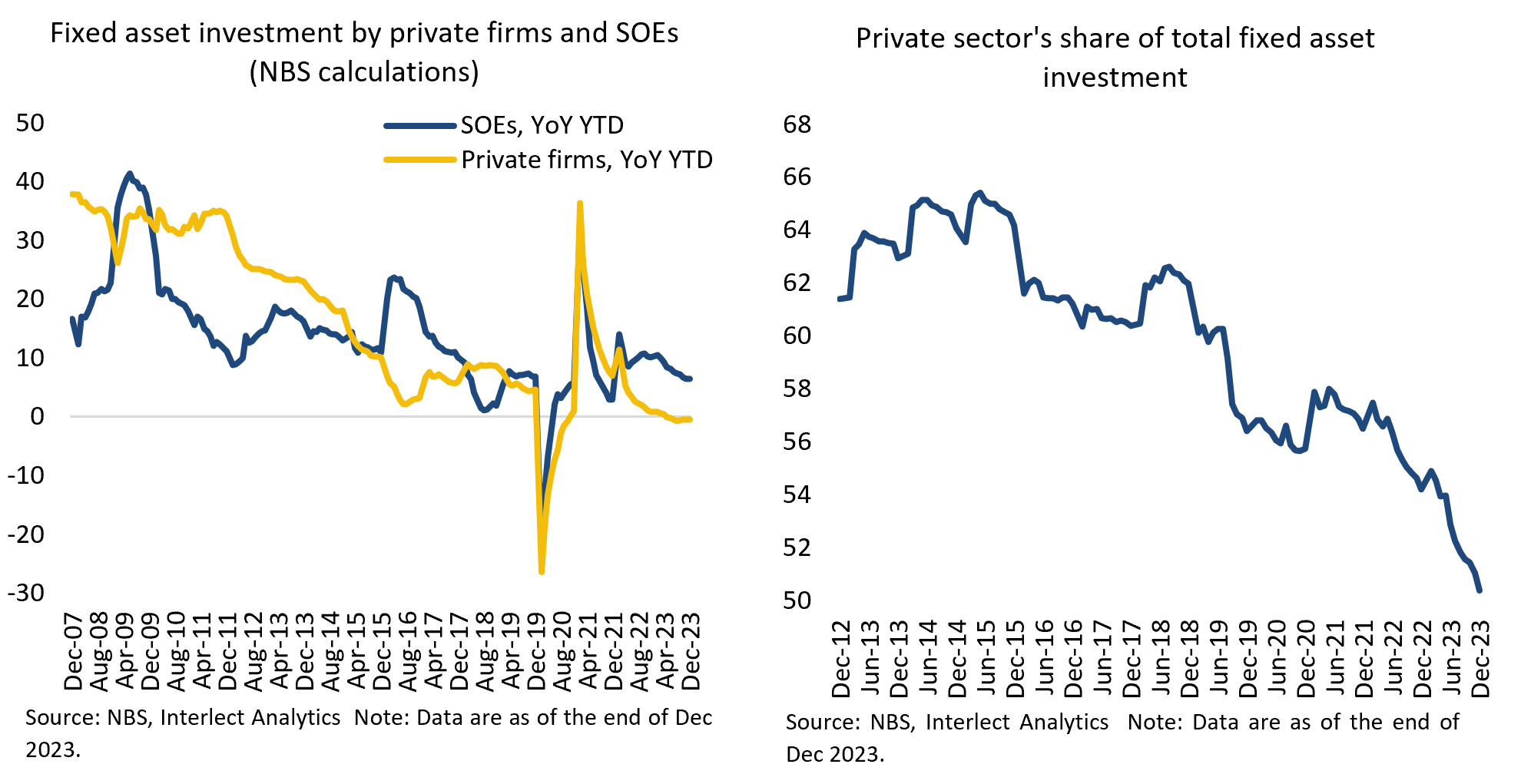

Looking at the overall ‘pro-growth’ tone of the report, we observe a gradual increase over the last two years. Yet, this has only taken the report’s ‘growth-friendliness stance’ back to the historical average. This return to the mean is partially driven by China’s renewed attempts to boost private business confidence and attract, or keep, foreign investment in the country. Private investment growth was negative last year, with the private sector’s contribution to total fixed asset investment falling sharply, largely due to the slowdown in the property sector.

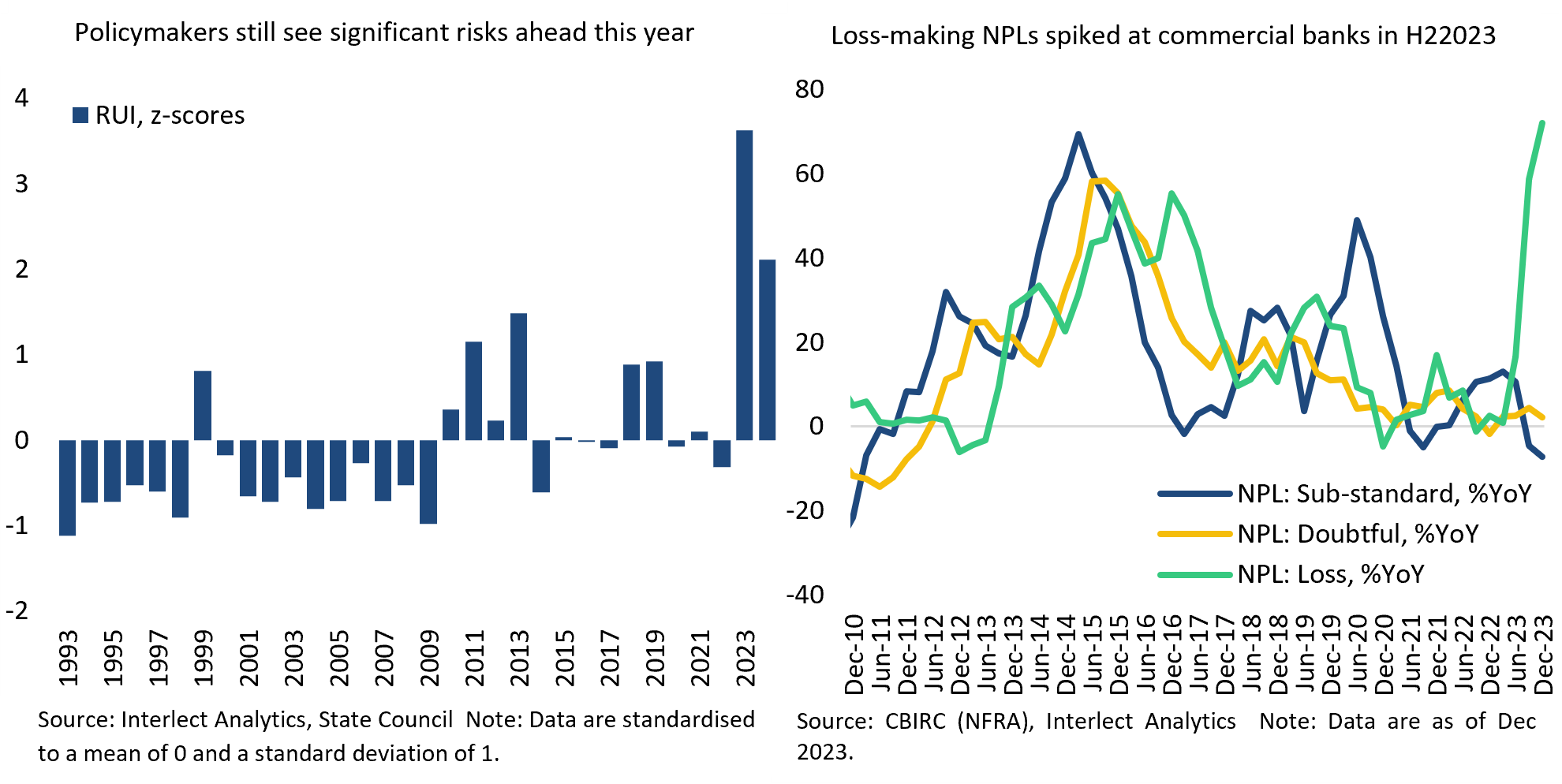

Despite a substantial decrease, our risk and uncertainty indicator, when applied to the report’s outlook section, remains at very high levels. Elevated levels can also be observed when applying the indicator to other party and government agency texts. As expected, policymakers’ focus here is still on the property sector, local government debt, and small- and mid-sized banks, which we have discussed extensively in our notes last year. Home sales and their impact on developers’ cash flows continue to look concerning to us, with a significant slump in the high-frequency data in 30 major cities year-to-date (see QuickScan: Data Dump February 2024). Commercial banks also registered a spike in downgrades of non-performing loans to the lowest category of ‘loss-making’ in the second half of last year, which illustrates policymakers’ ongoing concerns around small- and mid-sized lenders.

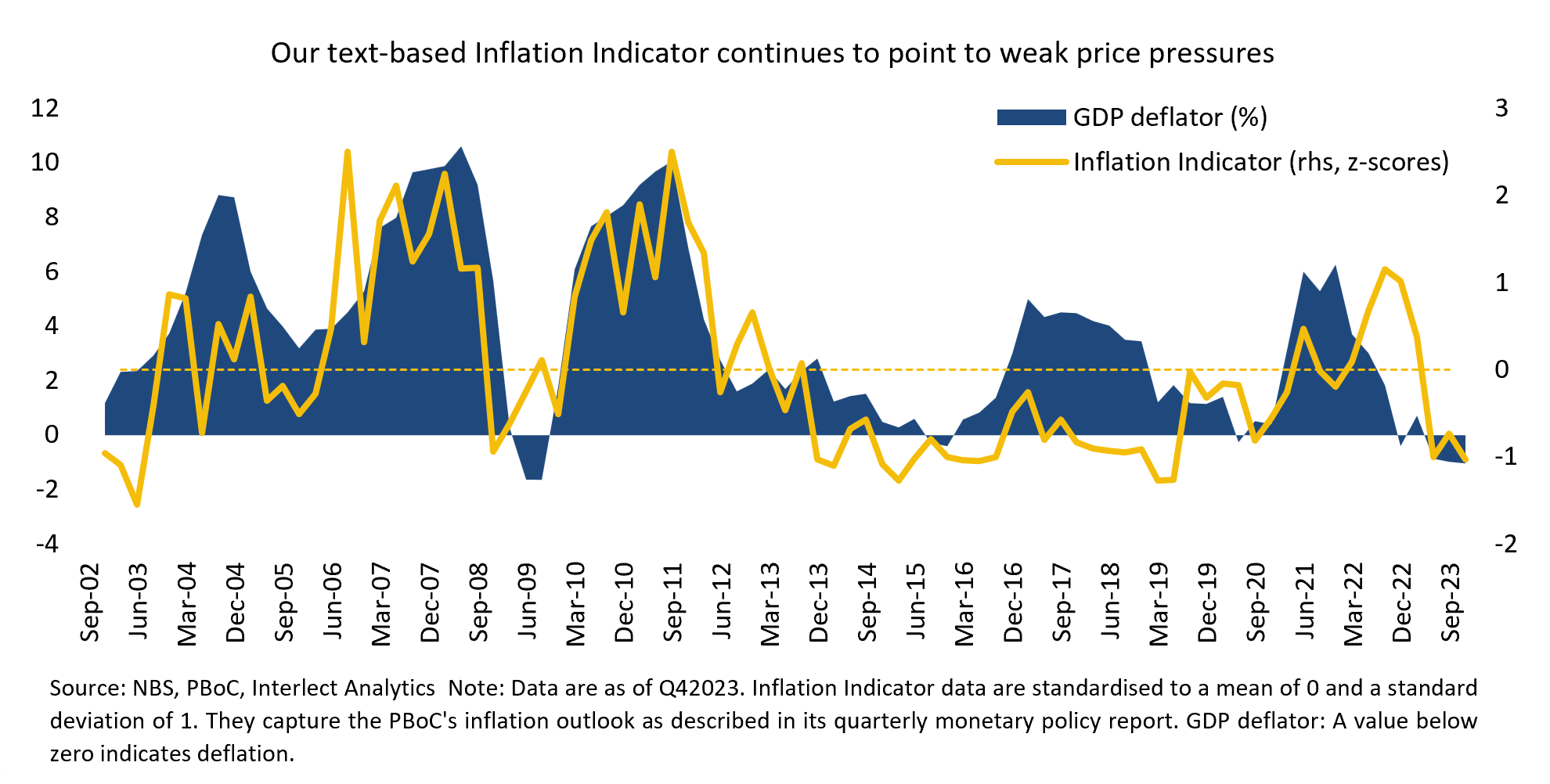

The government also set an inflation target of around 3% for this year, a goal we think is quite a stretch, given China’s inflation data continue to signal mild deflationary pressures. Our text-based inflation indicator also suggests subdued price pressures. That said, the 3% target should be seen more as a ceiling rather than an actual inflation target.

To sum up, the marked emphasis on the new economy in the report and other recent policy communications suggests that sectors singled out in these statements will likely receive significant support going forward. While this presents opportunities for those seeking exposure, it also entails increasing geostrategic risks, making prudent selection all the more important. Stimulus policy, while remaining supportive, will likely increase only modestly, as we have been arguing for some time now. However, compared to our negative outlook since China removed its Covid-related restrictions early last year, we have recently turned cautiously optimistic on the macro outlook, since some of the indicators we monitor are showing nascent signs of improvement (see DeepDive: Nascent Signs of an Improving Outlook in the PBoC’s Messaging and QuickScan: Can the External Macro Environment Prove to Be a Boon?).

----------

This report has been prepared by Interlect Analytics Pte. Ltd. It should not be taken as investment advice or a recommendation to buy or sell any security or investment product. Redistribution without prior consent is prohibited.