QuickScan: Taking Stock of Money Supply Developments

In this QuickScan, we delve into the latest money supply data. While macro data have recently painted a more positive picture overall, the gap between narrow and broad money supply remains deeply negative, pointing to continued caution among businesses and households. We explain why we think that matters.

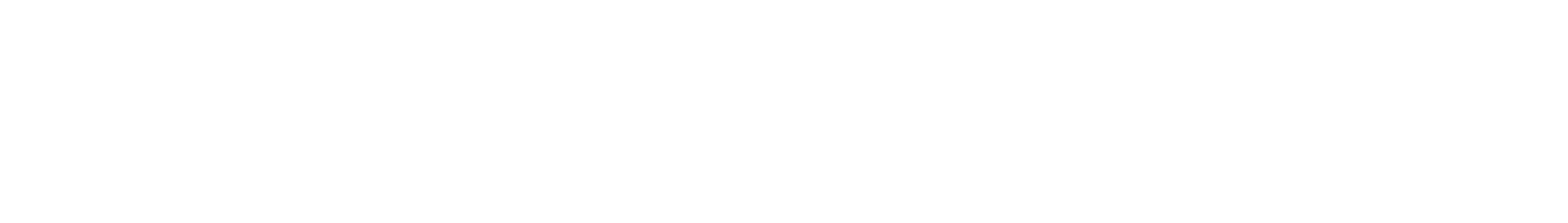

The gap between M1 and M2 remained deeply negative in August, although largely unchanged from the previous month. The spread implies that businesses are currently not keeping much liquidity to support investment and business expansion, suggesting they continue to see uncertainty amid subdued demand. It also points to lingering reluctance among consumers to spend. The gap is close to historical lows going back to 2007, indicating that a drastic deterioration should be unlikely, barring any material downside surprises in areas such as real estate and local debt or the external trade environment.

The relation between the M1-M2 gap and home sales remains robust, suggesting that the downbeat property sector continues to be a drag on capital spending and consumption. It is difficult to see how this would change materially without a significant improvement in the sector or alternative growth drivers.

While the correlation with the CSI 300 has been patchy in the longer-term, it has been strong (0.61) over the past five years.

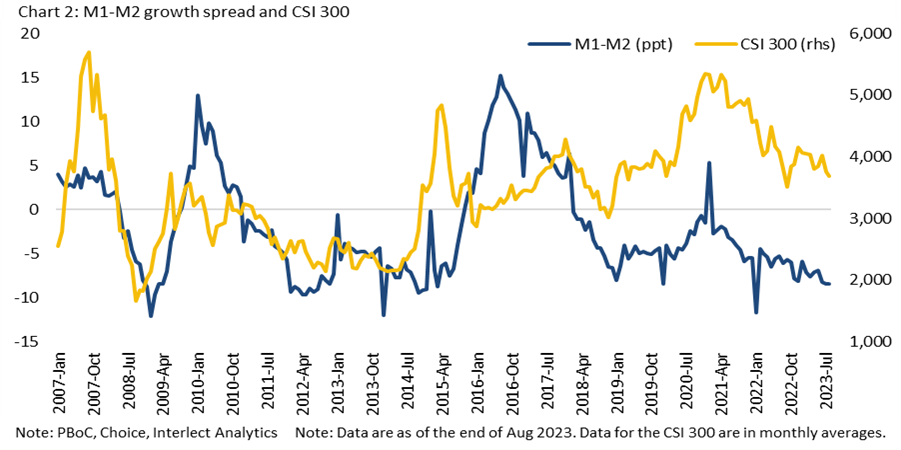

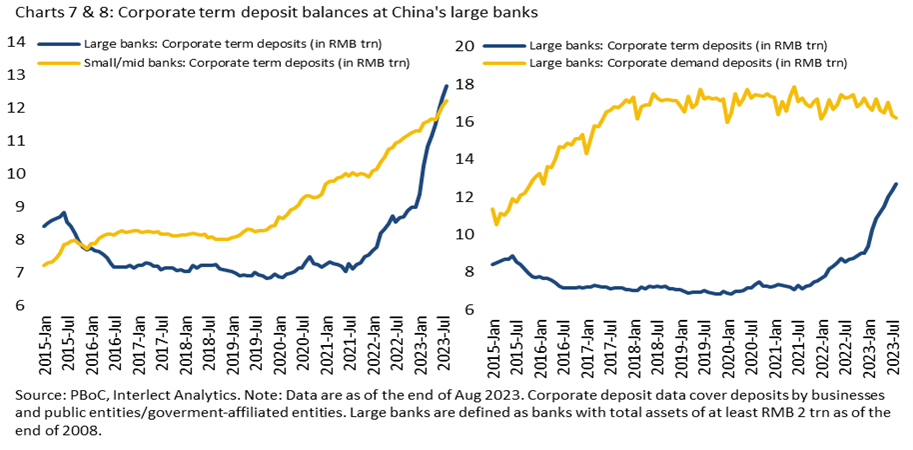

Data from China’s largest state lenders, including the big four, show that growth in term deposits by businesses and public organisations continues to significantly outpace growth in demand deposits, with the latter contracting over the last few months. Household demand for term deposits also remains robust, with deposit balances still up 21% year-on-year in August despite the strong base last year.

While growth in monthly new deposits has slowed against a very high base, savings levels have yet to show signs of reversing down towards the pre-pandemic trendline. The high term deposits may at least partially explain why inflation has been subdued due to a slowdown in the velocity of money.

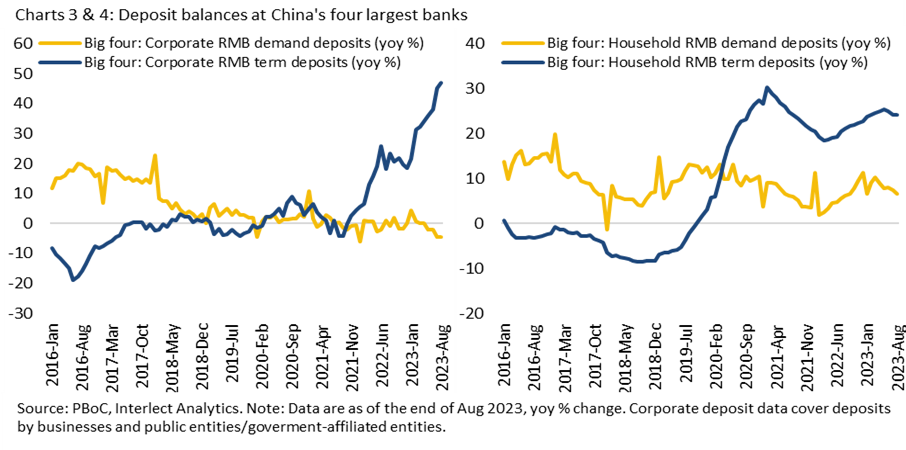

Data from China’s small and mid-sized lenders paint a similar picture.

The increase in deposits at large banks has been particularly marked since the start of this year, with term deposit balances of businesses and public organisations exceeding those at their small and mid-sized peers for the first time since 2015. While smaller banks have also been seeing strong inflows since the early days of the pandemic, we believe the recent jump in inflows into large lenders may be due to increased competition around deposit rates and more risk-aversion among depositors.

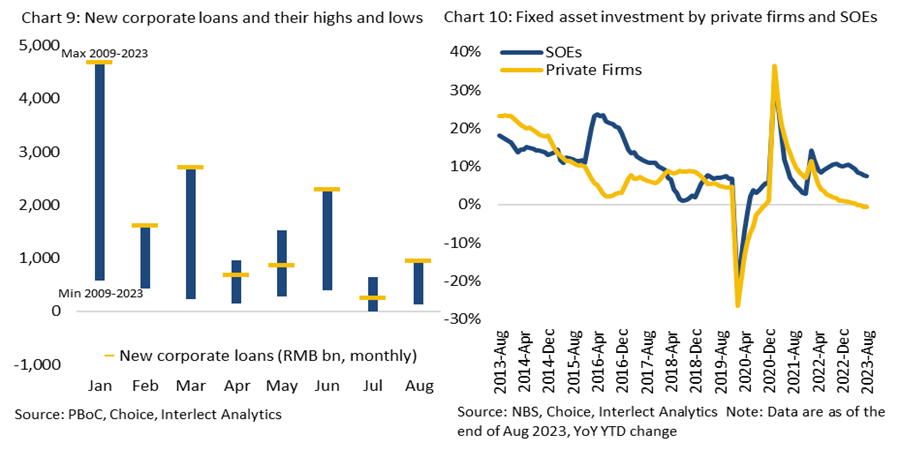

The weakness in demand deposits and drastic increase in term deposits is in stark contrast to the years prior to 2018 and, in our view, suggests that confidence in the economic outlook has yet to meaningfully improve. It also suggests that some of the strong corporate borrowing activity seen this year may have resulted in idle funds or capital being used for arbitrage opportunities, as fixed-asset investment, in particular private sector investment, remains subdued.

----------

This report has been prepared by Interlect Analytics Pte. Ltd. It should not be taken as investment advice or a recommendation to buy or sell any security or investment product. Redistribution without prior consent is prohibited.